White Americans gain the most from Trump’s tax cuts, report finds

NEW YORK TIMES

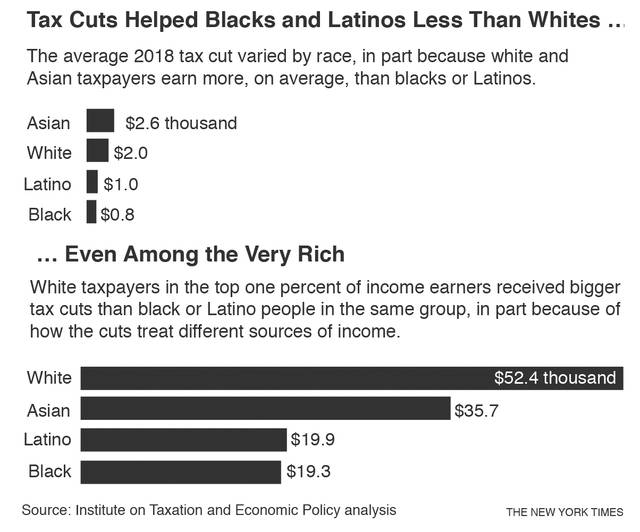

The average 2018 tax cut varied by race, in part because white and Asian taxpayers earn more, on average, than blacks or Latinos.

The tax cuts that President Donald Trump signed into law last year are disproportionately helping white Americans over African-Americans and Latinos, a disparity that reflects long-standing racial economic inequality in the United States and the choices that Republicans made in crafting the law.

The finding comes from a new analysis of the $1.5 trillion tax cut using an economic model built by the Institute on Taxation and Economic Policy, a liberal think tank, and released in a joint report with Prosperity Now, a nonprofit group focused on helping low-income Americans attain wealth and financial stability. It is the first detailed analysis of the law to break down its effects by race.

White Americans earn about 77 percent of total income in the United States, but they are getting nearly 80 percent of the benefits of the individual and business tax cuts generated by the new law, the analysis found. African-Americans received about 5 percent of the benefits, despite earning 6 percent of the nation’s income. Latinos got about 7 percent, although their share of all income is 8 percent.

In total, the analysis estimates, whites will get about $218 billion in tax cuts this year as a result of the law. Black and Latino Americans will get about $32 billion combined.

The analysis starts with a simulation of the law’s effects on Americans by income group, using historical tax data. On that front, its conclusions closely track those of distributional analyses by the Tax Policy Center and the Joint Committee on Taxation, Congress’ scorekeeper on the effects of the cuts. Both found that the vast majority of the law’s benefits would flow to the top 20 percent of U.S. income earners.

The economic policy institute’s model extends those analyses by combining tax data with race and ethnicity data from the Federal Reserve’s Survey of Consumer Finances. It took months to build.

Don't miss out on what's happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It's FREE!

The racial divide highlighted by the analysis is largely a product of the financial advantages that white people have long held. They earn more on average than black or Latino Americans, and are far more likely to be among the top income earners in the country. That means they were better positioned to gain from a law that delivered higher benefits to top earners, in total dollars and in percentage terms, than low- and middle-income Americans.

“The average income for white taxpayers is significantly higher than for black or Latino taxpayers,” said Meg Wiehe, deputy director of the economic policy institute. “That’s a huge driver.”

As a result, the average tax cut going to a white American household is more than double one going to a black or Latino one. The study found that the group getting the highest average cut was Asian-Americans, who have the highest average income of any of the groups.

It appears, though, that even among top earners, whites have fared better than other Americans under the law — probably because the tax cuts affect individual taxpayers differently depending on how they make their money.

High-earning white taxpayers, for example, are more likely to own pass-through companies such as limited liability corporations, and pay taxes on their profits through the individual income tax code. The new law includes a special 20 percent deduction for pass-through income, subject to some limitations. The pass-through break does not apply to high earners such as professional athletes who get most of their money from salaries.

The average tax cut, as a share of pretax income, for a white or Asian-American household in the top 1 percent of income earners was nearly 3 percent, the analysis found. For Latinos, it was 1.7 percent; for blacks, it was 1.2 percent.

“Even if you’re a successful black or Latino household in the top 1 percent, you’ve achieved the American dream, you’ve hit it out of the park,” said David Newville, director of federal policy at Prosperity Now. “You’re still not getting the same returns from this bill as a white household.”

The report’s authors note that Congress could have structured the cuts differently in ways that targeted lower- and middle-income taxpayers more directly. They also stress that by steering more money to whites, the law could exacerbate an already stark racial wealth divide in the United States.

The Census Bureau reported in September that the median income for white/non-Hispanic households in 2017 was $68,145. For black households, it was $40,258. For Hispanic households of any race it was $50,486.

White/non-Hispanic households make up about two-thirds of all households in the country, the census figures show. Blacks and Hispanics each constitute about 13 percent of households.

A poll conducted this month for The New York Times by the online research platform SurveyMonkey found that white Americans were far more likely to approve of the new tax law than those who are not white. The poll found that 55 percent of whites approved of the law, compared with 40 percent of Hispanics and 33 percent of blacks.

“Congress missed a tremendous opportunity” with the tax law, the report’s authors write, “to help low- and moderate-income families — particularly those of color — build the wealth needed to secure their share of the American dream.”

The analysis found that one way in which the cuts were relatively colorblind: Those geared toward middle-class families were, as a share of income, roughly the same across races.

But because so many more white taxpayers are in the middle quintile of income earners compared with blacks and Latinos, the white middle class reaped much larger benefits: just over $15 billion total, compared with just over $3 billion for middle-income Latinos and just over $2 billion for middle-income blacks.

© 2018 The New York Times Company