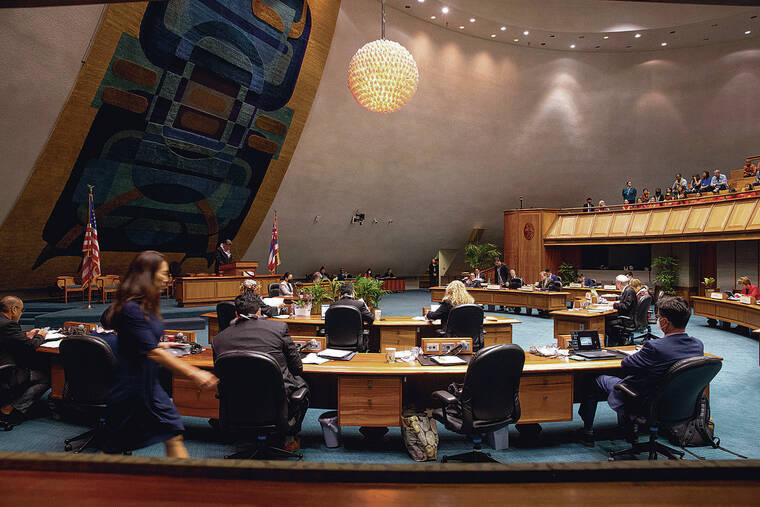

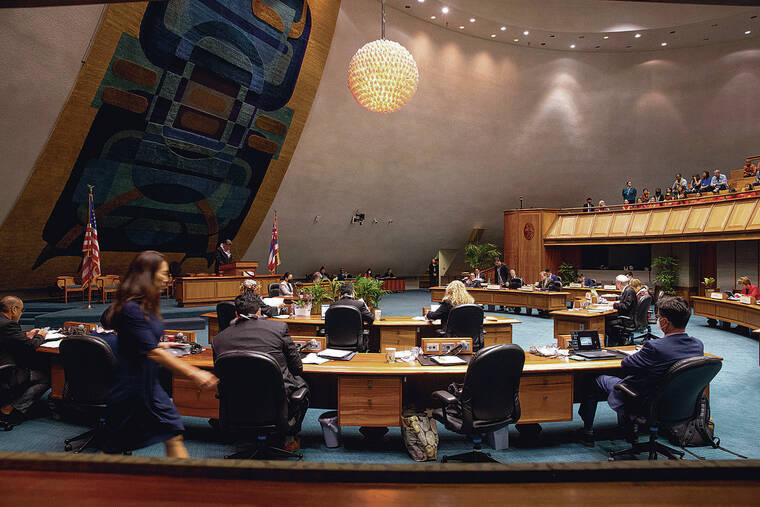

As the legislative session winds down

to a largely ceremonial finish on Friday, the

full House and Senate on Wednesday sent nearly 200 bills to Gov. Josh Green that include $1 billion to help Maui recover from the wildfires and another bill that gives counties the authority to regulate short-term vacation rentals on their islands, including the ability to ban them if they choose.

The House and Senate also approved sweeping tax relief aimed at easing Hawaii’s high cost of living for working families over the next seven years, adding up to about

$5 billion.

Some legislators in both chambers called it the biggest tax relief for residents in Hawaii history.

“It is major,” said Sen.

Jarrett Keohokalole, (D, Kaneohe-Kailua). “It is an

extremely significant action for our constituents.”

Sen. Donovan Dela Cruz (D, Mililani-Wahiawa-Whitmore Village) said the cuts by 2031 will reduce the tax burden on working-class families by 71%.

The bill has been endorsed by Green and raises the standard deduction this year and then every other year — along with adjustments for tax brackets in alternating years through 2031.

Dela Cruz said the standard deduction for joint tax filers will grow from $4,400 currently to $24,000 by 2031, and that the take-home pay for a family of four earning $88,000 stands to rise by about $3,600 as their tax bill drops to about $1,500 from about $5,100 under current law.

“Beyond serving our

immediate needs, this

bill casts a hopeful gaze toward the future, laying the groundwork for future generations to inherit a fairer and more equitable tax

system,” Dela Cruz told

colleagues.

But in the House on Wednesday, some representatives wondered out loud how the state will pay for the tax breaks in the future and questioned whether more affluent residents need tax relief.

In response during a post-session news conference, House Finance Chair Kyle Yamashita (D, Pukalani-

Makawao-Ulupalakua) said “it may appear that it favors the rich. But if you look at the numbers, the bulk of the taxes paid are paid for by the middle (class) down.”

The House, at the last minute Wednesday, deferred a bill that would have bypassed Hawaii’s long-standing practice of banning outdoor advertising by allowing the Hawai‘i Tourism Authority to sell naming rights on the Hawai‘i Convention Center.

House Bill 2563 started out directing the HTA to develop an app for tourists but ended up with new language giving HTA the authorization to sell naming rights for the convention center.

State Rep. Elijah Pierick (R, Royal Kunia-Waipahu-

Honouliuli) on Wednesday called HB 2563 an example of “gut and replace” — a legislative practice that led the state Supreme Court in 2021 to rule a previous law invalid because replacement language did not undergo the mandatory three readings in each chamber of the Legislature.

In its decision, the court did not specifically outlaw the practice of gut and replace. But it left open the possibility of legal challenges to future bills that fail to undergo the mandated hearings.

Later in the daylong House floor session, Pierick also called out an insurance-

related bill, HB 2394, as an example of “gut and replace.”

“The original content and theme are not the same as what we have today,” Pierick said.

But state Rep. Nadine

Nakamura (D, Hanalei-

Princeville-Kapaa), House majority leader, responded: “We did check with the Attorney General and we have gotten clearance that the subject matter is consistent with the theme of the bill and it can go forward.”

One of the most divisive bills approved Wednesday directs counties to develop ordinances to allow at least two accessory dwelling units on lots zoned for residential use by the end of 2026 in an effort to increase Hawaii’s stock of affordable housing.

Some House members said Wednesday that Senate Bill 3202 treats Honolulu differently from neighbor island counties — and runs afoul of the “home rule” philosophy that helped drive the separate bill giving counties the discretion to regulate — and even ban — vacation rentals, if they choose.

“Oahu and the suburban districts definitely do not want this,” Rep. Scot Matayoshi (D, Kailua-Kaneohe) told his House colleagues.

Like other concerned House members, Matayoshi said more ADUs could lead to unwanted urban density that “won’t be reversible.”

Rep. Linda Ichiyama (D, Fort Shafter Flats-Salt Lake-Pearl Harbor) said the bill leaves counties to deal with subsequent issues of increased traffic, parking, emergency response, demands on the infrastructure and other issues.

“Our Honolulu Council said this is not the right way for them to deal with ADUs,” Ichiyama said. “They said that very loud and clear.”

The bill survived a failed attempt by Rep. Gene Ward (R, Hawaii Kai-Kalama Valley) to defer it to next year and, instead, now goes to Green.

The 25-member Senate passed all of the bills it

considered on Wednesday, with one squeaking by on

a 13-12 vote.

SB 2342 mandates changes to Hawaii motor vehicle insurance coverage, including a provision that doubles minimum liability coverage required to $40,000 per person and $80,000 per accident.

Sen. Brandon Elefante (D, Aiea-Pacific Palisades-Pearl City) led off the dissent by saying that — even though minimum liability coverage requirements in Hawaii haven’t risen in 25 years —

now isn’t the time for an

increase, which will raise rates.

“At a time in which cost-of-living elements are increasing, insurance prices are going up and other costs are increasing, it would be difficult for me to support a bill that would cause a substantial potential increase to ratepayers,” he told colleagues.

Elefante also said he is concerned that more costly insurance will prompt more drivers to go without coverage, which is illegal.

Sen. Angus McKelvey (D, West Maui-Maalaea-South Maui) noted that the bill has merits but said the net effect in his view would be negative, with more uninsured motorists on Hawaii roads.

Sen. Karl Rhoads (D,

Nuuanu-Downtown-Iwilei) encouraged colleagues to vote for SB 2342 in part because damage expenses in cases still will exceed even increased coverage.

Rhoads said that, “$40,000 just doesn’t go very far these days, especially considering that medical expenses … have increased at a much higher rate of inflation than regular inflation. So we’re well past time to have a higher coverage minimum to protect those who are injured by the negligence of others.”

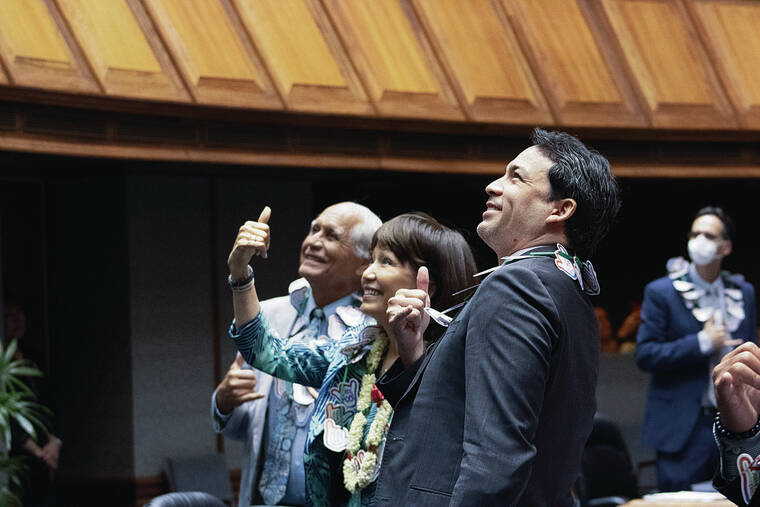

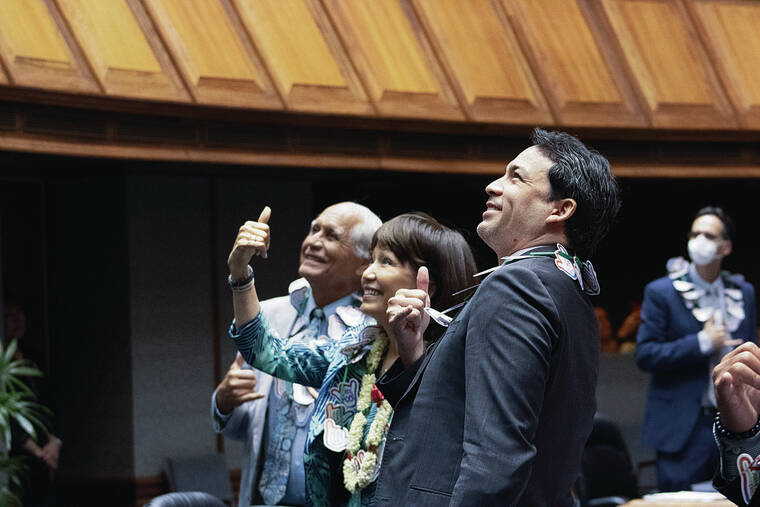

Both the House and Senate unanimously approved a more lighthearted bill that designates the shaka as the official gesture of the state.

To recognize SB 3312, dubbed the “shaka bill,” the Senate adjourned its floor session Wednesday with members standing and giving the famous thumb-and-pinkie wave.

“I officially move,” Sen. Glenn Wakai (D, Kalihi-Salt Lake-Pearl Harbor) said as majority floor leader, “that the Senate stand adjourned until 10:30 on Friday May 3rd … and adjourn with a moment of shaka.”

The last day of this year’s legislative session is Friday, and lawmakers have a few more bills to vote on then, including one that would add another $300 million to the state’s “rainy day” fund.