Pension fund exec optimistic despite $13.5B shortfall

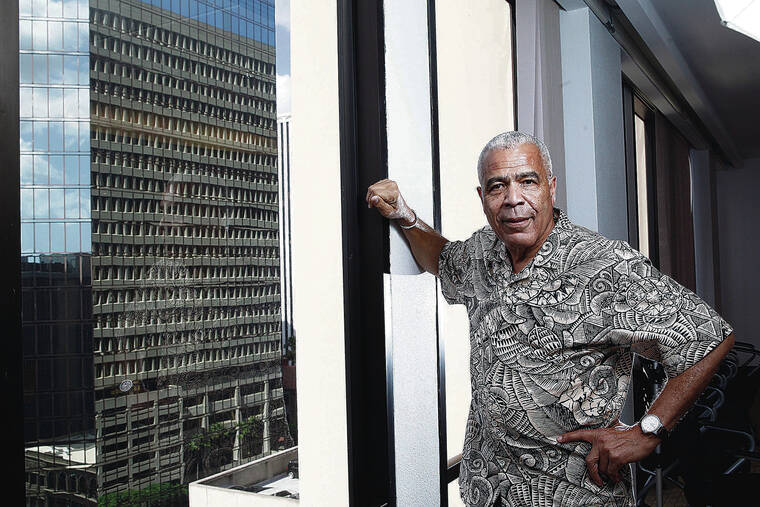

STAR-ADVERTISER / 2016

Thom Williams

It’s been an uphill climb for the state Employees’ Retirement System pension fund, but its top administrator says beneficiaries have nothing to worry about even though the fund has a $13.5 billion shortfall.

Legislative steps developed in 2017 that increased state and county employer contributions have put the fund on pace to be 100% funded by June 30, 2046. The fund’s risk-averse strategy has helped keep it out of harm’s way even though the stock and bond markets have been turbulent due to the Ukraine-Russia war and rising interest rates.

“Of the many unrelated concerns our members might have, the security of their ERS pension should not be amongst them,” ERS Executive Director Thom Williams said. “Each year, we perform a series of stress tests which presume highly unlikely adverse investment outcomes for sustained periods of time. Each test shows our plan as sustainable and solvency never coming into question.”

Hawaii’s largest public pension fund, which has been inching its way back to being fully funded after topping out at a $14.6 billion shortfall in fiscal 2020, posted a 0.9% gain in its fiscal second quarter that ended Dec. 31 and was down 0.8% through the first six months of fiscal 2023. The fund was up 3.7% in fiscal 2022 but gained a whopping 26.2% in fiscal 2021. It has been up six fiscal years in a row and nine of the past 10 fiscal years.

The ERS has set a 7% annual average target, or assumed investment return, to meet its financial obligations. The pension fund uses a four-year smoothing strategy to dampen the volatility in funding requirements year to year, either up or down.

“We remain hopeful of achieving our target return this year, but that appears increasingly more challenging,” Williams said. “The good news is we have substantial deferred gains from prior years to partially offset some portion of any shortfall we may experience this year.”

Don't miss out on what's happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It's FREE!

The pension plan provides retirement allowances and other benefits to 149,481 retirees, beneficiaries, inactive vested members and active public employees working for the state and its counties.

Irving, Texas-based actuary Gabriel, Roeder, Smith &Co. said in a January report that the ERS pension fund in fiscal 2022 improved its funding ratio — what is needed to meet its financial obligations — to 61.2% from 58.3% in fiscal 2021 and that its unfunded liability, or shortfall, declined by $724 million to $13.5 billion as of June 30. The actuary expects the ERS portfolio to be fully funded by June 30, 2046.

“The current global market environment is a challenging one, and the volatility in investment returns experienced over the last few months of the year reflects both near- and longer-term uncertainty,” Williams said. “As a long-term investor employing disciplined valuation techniques, we see risks and corresponding opportunities in virtually every market environment, including the present. When viewed in the context of overall market returns, our positive 0.9% in the fourth quarter of 2022 and our negative 0.8% return year to date places us favorably in comparison to our policy benchmarks and our public pension fund peers.”

Chief Investment Officer Kristin Varela, who took over the reins Jan. 17, said the ERS has actively deployed a risk-focused investment strategy throughout the recent interest rate and inflation movements. Varela was most recently deputy chief investment officer and interim chief investment officer for the Public Employees Retirement Association of New Mexico.

“Timing or predicting the fundamentals that drive these disrupters is nearly impossible, which is why ERS seeks to diversify away from a single-risk concentration to minimize the impact of any material market scenario,” she said. “As such, ERS is not any more or any less conservative in a rising interest rate environment, yet remains steadfast in its approach toward diversified and risk-balanced allocation that reduces reliance on growth assets (equities) while minimizing any negatively-skewed outcomes driven from either growth, rates, or inflation uncertainties.”