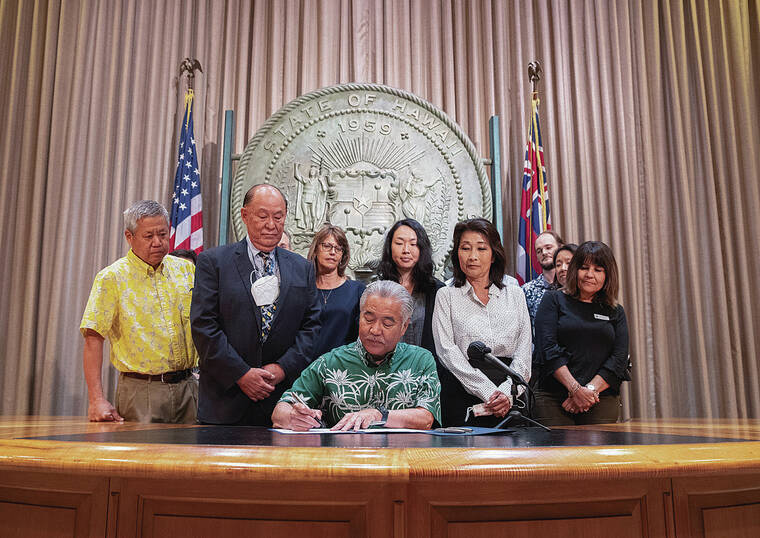

On Wednesday, Gov. David Ige signed House Bill 2510 into law, putting Hawaii on a path toward the highest minimum wage in the country while expanding an important working class tax credit at the same time.

As a small business owner, I say: It’s about time. No one can survive on $10.10 an hour — or just $21,000 a year — in Hawaii.

According to the state Department of Business, Economic Development, and Tourism (DBEDT), a Hawaii worker with no keiki, receiving employer-provided health insurance, needed to earn $18.10 an hour in 2020 just to make ends meet. After adjusting for inflation, that puts a minimum self-sufficiency wage in 2022 at $19.56 per hour.

HB 2510 will raise the state minimum wage from $10.10 to $18 in a series of manageable steps beginning this October, and ending on Jan. 1, 2028. It also makes the earned income tax credit permanent and refundable.

Together, these policies will increase the annual income of a minimum wage worker by more than $16,000 over the next six years, while also providing hundreds of dollars in annual tax breaks to working-class families. That’s good for business, because the folks who will see their incomes grow are the same folks that are our traditional customer base.

A growing number of business owners are coming to the same conclusion. The Hawaii Chamber of Commerce’s survey of businesses showed that:

>> 34% of businesses support a minimum wage increase to $18 hourly by 2026;

>> 15% preferred $18 hourly by 2028;

>> Another 27% supported the Chamber’s recommendation of a $15 hourly minimum wage; while

>> Only 25% of business owners said they wanted to see no raise at all.

$18 an hour is already below DBEDT’s 2022 minimum self-sufficiency wage; in 2028 it will be even further behind. But it still gets workers much closer. Today, a minimum wage earner needs to work 82 hours a week — two full-time jobs — just to pay for their own basic needs. In 2028, at $18 an hour, they will need to work closer to 52 hours a week. Clearly more needs to be done.

Our state should continue moving toward a living wage for all workers in Hawaii. Research consistently shows that wage increases not only stimulate spending in the local economy, they reduce poverty and inequality, which leads to greater social cohesion, lower rates of crime, and better health outcomes. A true living wage would help to break cycles of poverty by ensuring that pay is sufficient to cover household essentials, as well as occasional emergencies or unexpected expenses.

From the business owner’s perspective, this results in lower staff turnover, reducing recruitment and training costs. Productivity can increase, and there are even signs that raising entry-level wages may be linked to increased overall revenue.

Yes, some businesses may have to slightly raise prices to cover higher wages. But any business owner knows price increases are a built-in function of the economy, whether wages are rising or not. And when workers, who are also customers, are taking home thousands of dollars more per year in pay, the relatively small price increases will be well worth it for all involved.

Right now our economy is a race to the bottom. Businesses pay low wages, which keeps working families living in poverty, which forces the government to spend more money on social services, which requires more taxes from all of us — none of which helps businesses.

Let’s reverse that cycle: Have businesses pay a living wage, even if it means slightly increasing their prices. That will help bring working families out of poverty, and turn them into customers — helping businesses instead.

Daeshik Kim Lucas is the owner of Hawaiian Seat Covers Co.