As filmmakers, we are committed to making movies in Hawaii that focus on local stories, and we are always thinking about how to sustain a thriving film community and industry. With states competing to welcome productions to fuel economies post-pandemic, the Hawaii film industry may be in jeopardy if state policymakers do not prioritize the time extension for the state film tax incentive. We urge our lawmakers to maintain these tax benefits to ensure that our state can continue to create jobs and invest in independent filmmakers who depend on resources to produce films in Hawaii.

We have been fortunate to present Hawaii through the lens of local filmmakers in venues across the world. For example, our film, “Every Day in Kaimuki,” was the first feature directed by a Native Hawaiian to be shown at Sundance. In 2021, the award-winning film, “I Was a Simple Man,” premiered at Sundance and was hailed by The New Yorker as one of the Top Five films of the year.

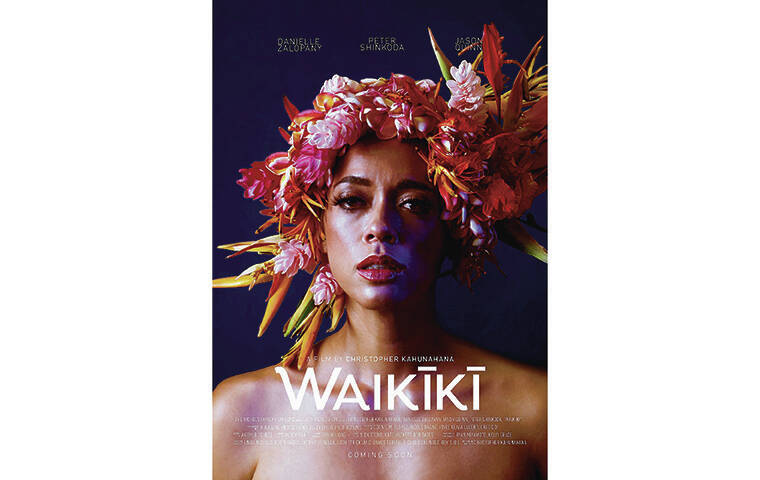

Along with local feature films like Chris Kahunahana’s “Waikiki” and many more in development, like the forthcoming “Makawalu” from the Hawaii International Film Festival, we are all examples of the benefits of the state’s tax incentives. “I Was a Simple Man” relied on the production tax incentive program to enable us to employ a large cast and crew of Hawaiians and locals. “Moloka‘i Bound,” which will go into production this year, will also rely on the incentive program.

It is extremely challenging to make films of any budget range. Ideally, these incentives help to make space for Native Hawaiian and local stories and storytellers.

In 1997, Hawaii was one of the first states to introduce a film tax credit. More than 20 major productions have come in recent years, including the latest “Aquaman” and “Jurassic Park: Fallen Kingdom.” The film productions have not only contributed $311 million directly into Hawaii’s economy, they also have helped create more than 54,000 high-paying skilled jobs here, ranging from construction to hairdressers to catering to skilled technical labor. Local residents received $99.2 million in wages in 2019 alone.

Local businesses have also benefited, with more than $95 million going to contractors, caterers, hotels and others. State law requires Hawaii to track the spending by film productions on local businesses to ensure the tax credit is working. The program is clearly working, as evidenced by the fact that in 2019 out-of-state goods and services used in production accounted for only $10 million of the entire $311 million; the rest went directly to Hawaii residents.

Most importantly, we, along with many other creators, are investing in and committing to creating a film industry that highlights and benefits local creators. A new generation of filmmakers at the University of Hawaii Academy of Creative Media is learning to tell Hawaii stories through cinema. The film program is the fastest-growing major at the University of Hawaii-West Oahu, with more than 300 students in 2021. The school recently opened a $37 million state-of-the-art new media facility to support the next generation of filmmakers.

While there is still much to be done to create a sustainable film industry in our state that benefits Hawaii storytellers, the tax incentives are an important first step to creating this sustainable future.

Our elected officials should support the sunset extension to the tax credit which will help Hawaii continue to be an economic leader, create good jobs, and support local communities. Our state’s credit is a model for the nation, showing how film production can support well-paying middle-class jobs and families, while also supporting homegrown stories.

Alika Maikau Tengan and Chris Makoto Yogi are award-winning Hawaii filmmakers.