A wealth tax and a higher tax on fuel are among measures Hawaii’s governor is considering to help plug a projected $1.4 billion state budget shortfall.

Linda Chu Takayama, chief of staff for Gov. David Ige, informed the House Finance Committee on Tuesday that these two types of taxes are possibilities to increase state revenue and partly offset a decline driven by coronavirus pandemic impacts.

Takayama also mentioned that halting general excise tax exemptions and credits is under consideration as well by the governor, who is formulating a detailed state budget proposal with specific amounts for revenue and spending the Legislature expects to receive soon.

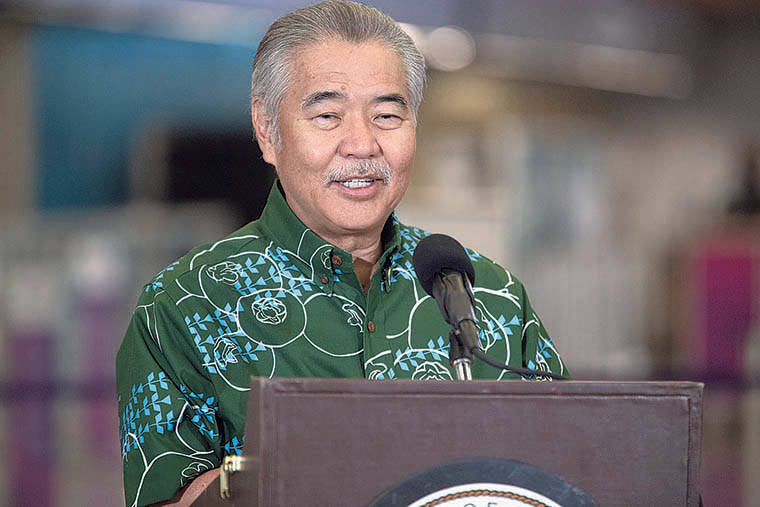

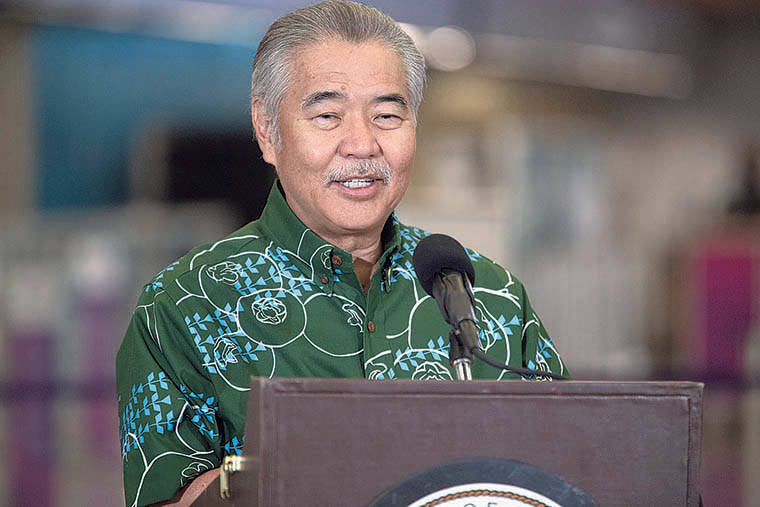

Ige recently said that raising taxes during an economic downturn is “the last thing” his administration wants to do. He has taken

a similar stance with imposing furloughs on state workers to reduce expenses.

But tax increases are likely going to be considered by state lawmakers regardless of whether Ige includes such proposals in his detailed budget plan.

Rep. Amy Perruso

(D, Wahiawa-Whitmore- Poamoho) said she plans

to introduce a bill that would increase the state

income tax rate on Hawaii residents with high incomes.

A similar measure that passed the House Finance Committee last year but was not heard by a Senate committee would have raised about $60 million annually, according to a state Tax Department assessment.

Higher rates in last year’s bill, House Bill 2385, ranged from 9% for individuals with annual incomes over $100,000 up to 13% for individuals earning more than $300,000.

“Our intention is to provide alternatives to austerity measures (such as furloughs or layoffs),”

Perruso, a House Finance Committee member, said

in an interview.

Ige originally proposed furloughs for thousands of state employees that had been scheduled to begin Jan. 1 but are now postponed until July, when the next fiscal year begins.

Other means for increasing state revenue advocated by Perruso include suspending general excise tax exemptions for four years, reducing the estate tax exemption, creating a property tax surcharge on homes valued over $2 million to help pay for public schools and increasing the state’s fuel tax.

“It’s not only an opportunity for raising revenue; it’s about using taxes to eliminate the gap between the rich and poor,” she said. “We can do both things at once.”

House Speaker Scott Saiki, in an interview, noted that the Legislature has previously turned to tax policy changes to alleviate budget crunches amid severe economic downturns, such as

a temporary suspension in 2011 of general excise tax

exemptions on nearly two dozen business activities that was forecast to generate about $400 million to help close an expected

$1.3 billion budget gap in

the aftermath of the Great Recession.

Lawmakers in 2011 also voted to increase the vehicle registration fee and vehicle weight tax.

Saiki said he’s “completely open” to a suspension of tax exemptions and credits, but he’s wary about tax increases.

“My general suggestion

to House members is we should not feel that we need to tax ourselves out of the pandemic,” he said. “We need to be careful when

considering changes to tax policy.”

Last year the Tax Foundation of Hawaii raised concerns about the bill to increase income tax rates

on the wealthy.

“This bill, if enacted, will reinforce the image that

Hawaii is a poor place to live, work, and invest, underscoring the poor business climate,” the foundation said. “To what lengths will we go to chase people out

of our state?”

Supporters of the bill

included the League of Women Voters of Hawaii

and the Pono Hawaii Initiative, led by former state

lawmaker Gary Hooser.

Takayama said at the House Finance Committee briefing that she did not have details on hand to list all tax increases being considered by the Ige administration or how much in total they could generate. But she said tax hikes on the table include a potential increase to the state’s “barrel tax” on fuel and would not burden “ordinary individuals” other than possibly folks at the

upper end of wealth.

Any tax increase plans

Ige puts forth would be

part of a package of bills

the governor submits to the Legislature scheduled to open its 2021 session next week.