State and employers blindsided by jobless surge in Hawaii

CINDY ELLEN RUSSELL / CRUSSELL@STARADVERTISER.COM

Cha Thompson, left, co-founder of Tihati Productions, had no choice but to lay off approximately 700 employees. Thompson spends time with her family, Nicole, Afa and Tihati, 3, on the shores of Waikiki.

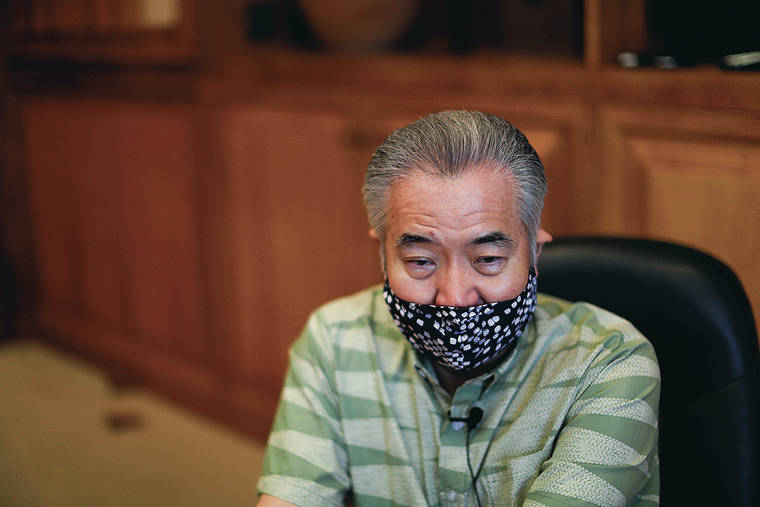

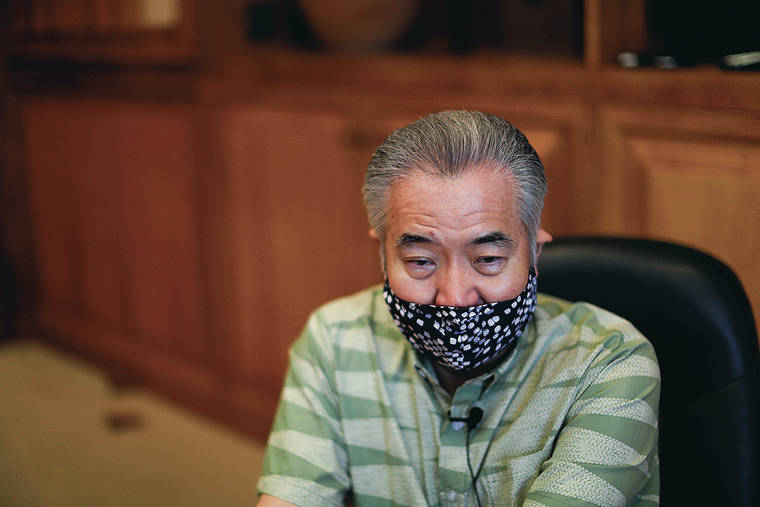

JAMM AQUINO / JULY 16

Hawaii Gov. David Ige, shown during an interview with the Star-Advertiser at the state Capitol in Honolulu, had announced three days before that he was delaying the opening of tourism to Sept. 1.

Tihati Productions began 2020 with the expectation that this year could be its best in business.

The entertainment company, which runs 14 luau statewide and operates the most lounges and convention entertainment in Hawaii, hadn’t even come off a five-decade high when COVID-19 reared its ugly head.

Its 50th-anniversary gala, which drew about 1,000 attendees to the Sheraton Waikiki on Dec. 14, was the first time in the company’s history that its four shows on Oahu, Maui and the Big Island went dark to enable a group of 100 singers, dancers and musicians to perform. Before that, Sept. 11, 2001, was the last time that multiple, but not all, shows stopped.

Then came COVID-related lockdowns and massive drops in travel demand, and everything went dark again. Conventions began canceling future business, and the company had to give back up to a couple of years of deposits.

“We’re all out of work now, and there are lots of bills to be paid,” said Cha Thompson, who along with her husband, Jack Thompson, founded the company where her son Afatia Thompson now serves as president and daughter Misty Mokihana Thompson-Tufono is executive vice president.

Ultimately, Cha Thompson said, the company had to furlough some 700 of its approximately 1,000 dancers, singers and dancers. Thompson worries how long the workers can stay afloat given that tourism hasn’t returned and the federal unemployment stimulus is drying up.

Don't miss out on what's happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It's FREE!

“We couldn’t have planned for this,” Thompson said. “I want to keep everyone that is hurting in prayer. I feel like we need more help than just the politicians. We all need the blessings.”

There’s been a flurry of new Worker Adjustment and Retraining Notification Act notices. So far this month, DLIR has received COVID-19 related notices from 16 companies, including T-Mobile, DFS Group LP, The Laylow Waikiki, Hilton Grand Vacations Honolulu, Hilton Grand Vacations Waikoloa, United Airlines, CareResource Hawaii Maui, Hyatt Centric Waikiki Beach, Miyako Restaurant, Halepuna Waikiki, Halekulani, Sea Life Park, Adventist Health Castle, Big Island Candies, Fairmont Orchid and Trump International Hotel Waikiki.

The notices run the gamut from extended furloughs with benefits to new layoffs and even business closures. Quite a few employers have told DLIR that previous furloughs that they implemented as short-term actions might now extend six months or more.

The notices come in the wake of Gov. David Ige’s decision to postpone the start of a pre-arrivals COVID-19 testing program from Saturday to at least Sept. 1.

They also come as the federally funded $600 a week plus-up is set to expire July 31. The 13-week-unemployment extension, authorized through the CARES Act, also is slated to end Dec. 26.

It remains to be seen whether even tougher times are ahead for Hawaii’s unemployed. Federal lawmakers might pass another stimulus bill, but it’s uncertain as to whether the measure would continue to fund these programs even partially.

“Congress appears poised to extend an extra federal COVID-19 benefit albeit at lower than $600,” DLIR Deputy Director Anne Perreira-Eustaquio said in a statement. “However, for the week ending July 25th, (it) will be the last week of $600 payments to claimants. If anyone is still waiting on payments for any claims made from April 4 through July 25, you will be made whole and you will receive those benefits.”

Perrira-Eustaquio is running the department while DLIR Director Scott Murakami remains on leave. So far, Ige’s office has declined to provide any details about Murakami’s absence.

DLIR spokesman William Kunstman said the state also has triggered another extended benefits program, which would give Hawaii residents another 13 weeks of unemployment behind the initial 26 weeks as long as Hawaii stays eligible.

Hawaii residents also might also be eligible for a $100-a-week plus-up program created by the state Legislature using $230 million from CARES Act funds that were allocated to the state. The program is expected to run from Saturday to Dec. 30, but the money isn’t payable if the federal government authorizes another plus-up benefit of more than $300.

Hawaii employers also are reeling from uncertainty in a climate where lockdowns continue as COVID-19 continues spreading across Hawaii and the mainland.

Sea Life Park said it intends on Friday to permanently lay off 55 employees who were originally placed on furlough March 17.

“We are taking this action because of COVID-19-related business circumstances that were not reasonably foreseeable. We did not foresee how significantly and for how long a time the epidemic and related governmental lockdown orders would impact our business,” Sea Life Park General Manager Valerie King said in the notice. “We also did not foresee that lockdown orders, initially issued for short durations in only a few cities, would spread throughout the country and be repeatedly extended. Nor did we foresee that these events would gravely impact our business not merely for a short period, but now for the foreseeable future.”

Even the Trump International Hotel Waikiki is not immune. The company filed a new WARN notice July 20 informing the state that due to the state’s many delays in reopening tourism, it anticipates that temporary furloughs and reduced work schedules will last at least six months for an additional 112 employees.

The state wasn’t well positioned to withstand COVID-19, either.

First, DLIR was hamstrung by an antiquated computer system, which couldn’t keep pace with the onslaught of unemployment insurance claims and caused many applicants to wait months for financial relief. The system’s limitations also hampered the start of Pandemic Unemployment Assistance.

Then the department began grappling with fraudsters who have plagued the process in other states as well. Altogether the state has paid out $35.9 million in fraudulent claims, mostly from fraudulent PUA applicants as eligibility requirements and employer- provided wage data make it difficult for regular unemployment insurance applicants to commit fraud.

DLIR has intercepted fraud and stopped another $125.3 million in fraudulent claims from being paid. It’s also denied claims for 44,298 out of 93,994 PUA applicants — although some of the denials are in review.

DLIR exhausted its unemployment insurance trust fund July 10 and is now borrowing money from the federal government to cover a COVID-19-related surge of claims that’s topped a quarter of a million since the pandemic began.

It didn’t take long for DLIR to spend down the nearly $597 million that was in the fund at the start of the year.

COVID-19-related new weekly claims peaked at 53,112 in April.

DLIR is finally beginning to catch up on what was once a massive backlog of claims. On Thursday the department reported that it had processed 92% of the valid unemployment insurance claims.

As of Thursday DLIR had paid 158,356 claims out of the 172,221 that it had deemed to be valid. There had been 258,847 claims filed. Another 13,865 claims are awaiting further vetting by DLIR.

Perreira-Eustaquio said the number of claims requiring departmental action is stable but that it’s still receiving some 8,000 new claims each week.

Thanks to the CARES Act, Hawaii and other states can borrow federal funds without interest during 2020.

The state has issued $2.3 billion in benefits from March 1 to Thursday. Though additional outlay is expected, Hawaii claimants don’t need to worry that the state will run out of money to pay them. However, DLIR might end up paying interest on federal loans to cover the payments unless further federal or state stimulus is approved.

“The best way to think of it is we have a line of credit with the U.S. Treasury for unlimited benefits. The Congress has made those loans interest-free through the end of the year. It remains to be seen if they will extend that deadline or forgive the debt, both of which have been discussed in D.C.,” Kunstman said.