Oahu property tax payers can pay in installments

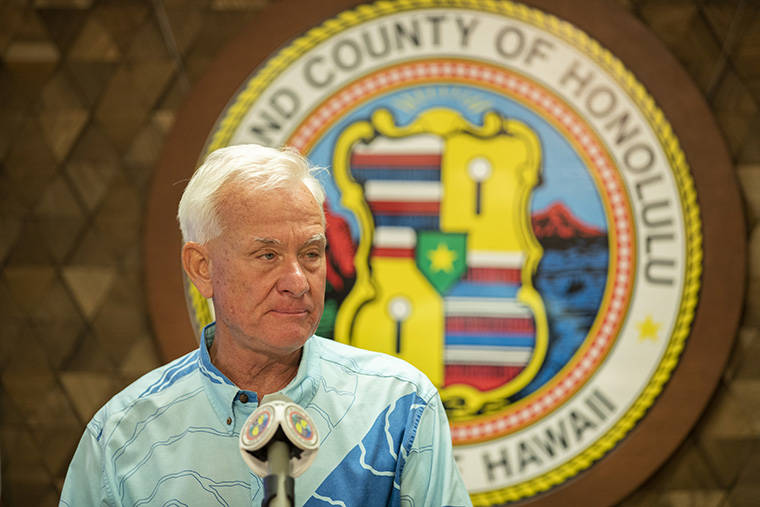

CINDY ELLEN RUSSELL / CRUSSELL@STARADVERTISER.COM

“Instead of having to make a lump sum, six-month payment come August, it can be paid over a longer period of time through four installments with no penalties, no interest assessed.”

Mayor Kirk Caldwell

All property tax payers on Oahu will have more time to pay the major portion of their August tax bills under a plan unveiled by Mayor Kirk Caldwell on Wednesday.

“Instead of having to make a lump sum, six-month payment come August, it can be paid over a longer period of time through four installments with no penalties, no interest assessed,” Caldwell said.

Meanwhile, city officials announced that they anticipate the upcoming fiscal 2021 budget to be hit with a $130 million shortfall as a result of the economic downturn caused by the pandemic, but said they already had made plans to deal with it.

City Budget Director Nelson Koyanagi said businesses, residents and those in other property tax classifications would be eligible for the one-time-only, interest-free deferrals. They will be issued “coupons” with their August bills allowing them to pay on Aug. 20, Sept. 20, Oct. 20 and Nov. 18.

All property owners are experiencing some kind of economic hardship, so no proof of a financial burden needs to be presented to get the deferral, Koyanagi said.

“If you’re a tax payer, you qualify,” he said.

Don't miss out on what's happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It's FREE!

Property taxes are the city’s largest source of revenue. Property owners typically pay their taxes in two installments — in February and August.

The new plan does not allow people to have their property tax bills forgiven, and Caldwell and other officials stressed the need for the city to maintain its revenue base.

Property taxes are “used to pay salaries for police officers, firefighters and all other city employees. It’s used to pay for debt service on bonds that the city issues, and for all of the expenses we incur to provide core city services,” Koyanagi said.

While there are no immediate plans to foreclose on property owners who are delinquent in paying their taxes, city ordinances do permit it, Koyanagi said.

“But there’s a process you go through, and it’s not something that happens overnight,” he said. “We try to work with the taxpayers to help them to be able to get current on their taxes … but after a certain point, there’s a possibility that there could be a foreclosure.”

The plan does not need to be approved by Council members, Koyanagi said.

Caldwell noted that council members have been deliberating on a proposal that would allow coronavirus-impacted businesses to defer paying their property taxes Opens in a new tab for an undetermined amount of time.

He thanked council members Carol Fukunaga and Ann Kobayashi for floating the original idea, but said his plan provides a deferral of payment for all.

Kobayashi said she likes Caldwell’s plan, but hopes he will consider providing small businesses grants from out of the projected $387 million in cash expected through the federal government’s $2.2 trillion Coronavirus Aid, Relief and Economic Security package.

“They can pay in installments, but if they don’t have any money … they can’t do anything,” Kobayashi said.

Caldwell said he will work with the Council’s newly formed Select Committee on Economic Assistance and Revitalization on how the city will spend the CARES money. The administration does not need Council approval for how the money is to be spent.

“We are looking at ways we can use the CARES money to help small businesses,” the mayor said. “As retail (merchants) open up next week, they’re going to have to spend money on modifications, and if they have no money to spend, how do they do these so they can start to earn money?”

Caldwell Chief of Staff Gary Kurokawa said about 32% of the CARES money, which is required to be spent only on COVID-19, is being directed to first-responder needs.

As for the $130 million shortfall in next year’s $2.8 billion operating budget, Council Budget Chairman Joey Manahan said the city anticipates a loss in revenues from several sources, including the motor vehicle weight tax and parking fees.

Koyanagi said his staff has in recent weeks already made about $135 million in cuts to various city agencies. The Department of Transportation Services is taking a big hit, including a reduction in rail operations funding.

Asked after the meeting if that reduction in the DTS budget is because the city does not anticipate the first East Kapolei-to-Aloha Stadium segment of the $9.2 billion rail project will be ready to open by the end of the year as scheduled, city officials said they would not be able to answer that question Wednesday.

Officials with the Honolulu Authority for Rapid Transportation told Council members last month that it expected its own shortfall of about $80 million in construction funds Opens in a new tab as a result of lower-than-forecast dollars coming from the state excise and hotel room taxes.

Koyanagi said funding for TheBus and HandiVan services are also being cut, but noted that an additional $91 million in CARES money the city is receiving can only be used for transportation-related costs. “So bus and HandiVan services shouldn’t be affected,” he said. That money cannot be used for rail operations, he said.

Caldwell assured Council members that the city won’t be furloughing any of its roughly 10,000 employees as a result of the shortfall.