Employers giving paid leave getting tax credits in new law

ASSOCIATED PRESS

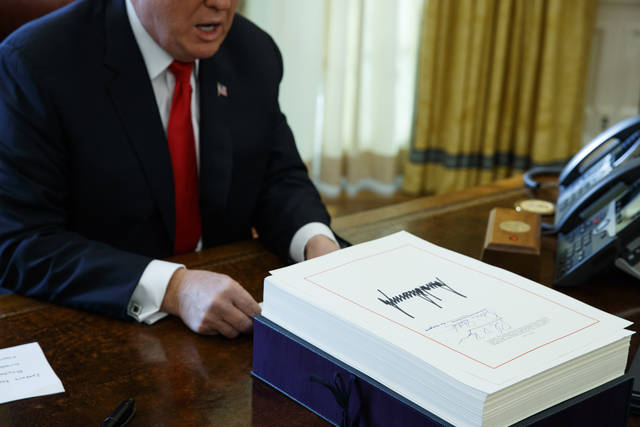

In this 2017 photo, President Donald Trump speaks with reporters after signing the tax bill and continuing resolution to fund the government in the Oval Office of the White House in Washington. Employers who offer paid family and medical leave to their workers earning up to $72,000 a year can receive tax credits under the new tax law, the government has affirmed. The Treasury Department issued guidelines today for the tax credit, which is available to employers for leave paid this year and next.

WASHINGTON >> Employers who offer paid family and medical leave to their workers earning up to $72,000 a year can receive tax credits under the new tax law, the government has affirmed.

The Treasury Department issued guidelines toay for the tax credit, which is available to employers for leave paid this year and next. The credit was part of the $1.5 trillion package of individual and corporate tax cuts that Republicans in Congress enacted and President Donald Trump signed into law in December. It expires in 2020.

The idea behind the credit was to encourage companies to offer paid time to their employees for family responsibilities, relieving some financial pressure. Under the guidelines, employers can get a tax credit equivalent to a percentage of the wages normally paid to employees during any period — up to 12 weeks — that they are on family or medical leave.

Employers are allowed to take the credit for paid leave to workers who earned $72,000 or less in the previous year, 2017 or 2018. To qualify, an employer must have a written policy covering all workers employed for a year or more. The policy must provide at least two weeks of annual paid family and medical leave for each full-time qualified employee, and at least a proportionate amount of leave for part-time qualified employees.

It also must pay at least 50 percent of the employee’s wages during the leave.

Paid leave can be provided for the birth or adoption of a child; caring for a spouse, child or parent with a serious health condition; a serious health condition that makes the employee unable to work, or a family emergency arising from a spouse, child or parent who is a military service member being on active duty.

Don't miss out on what's happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It's FREE!