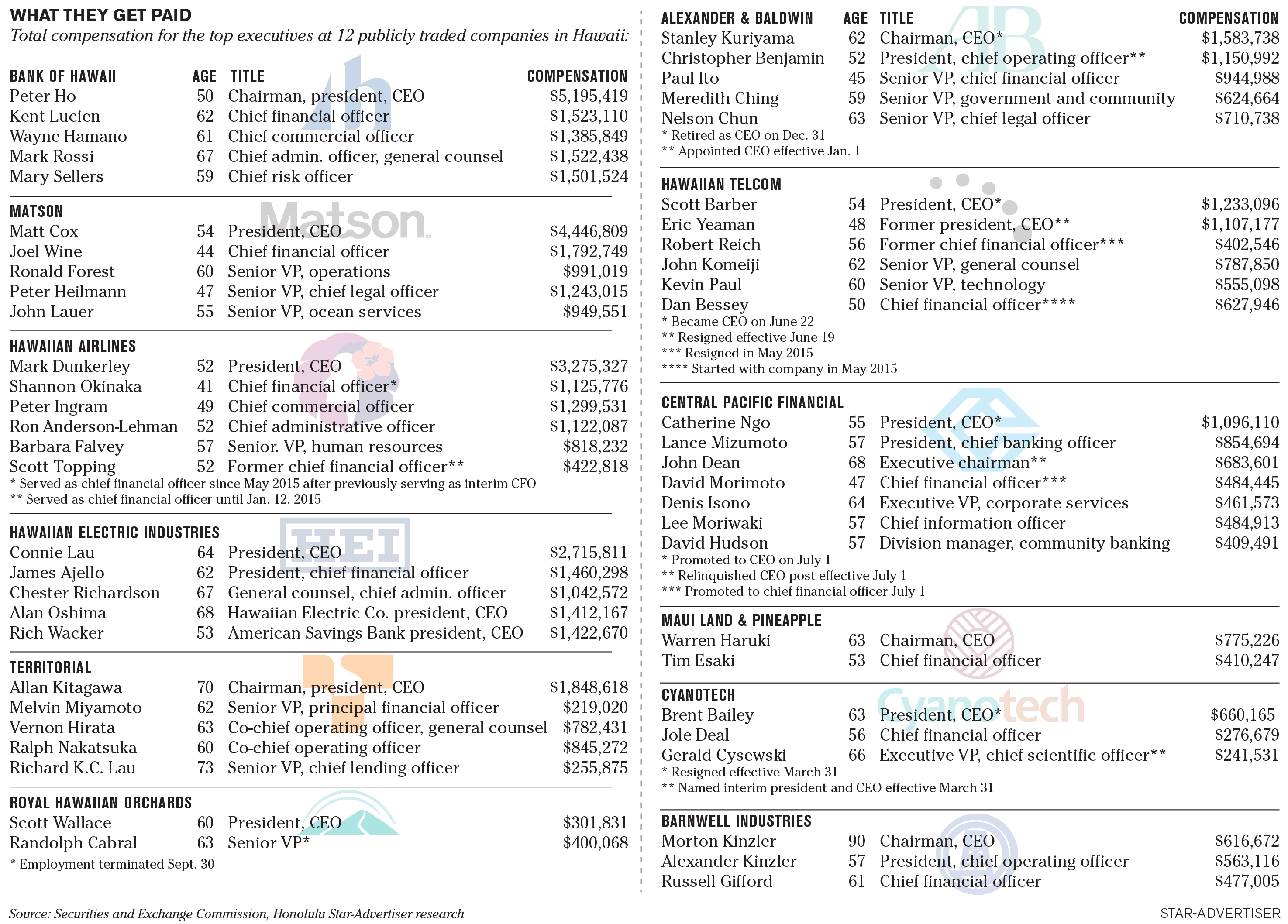

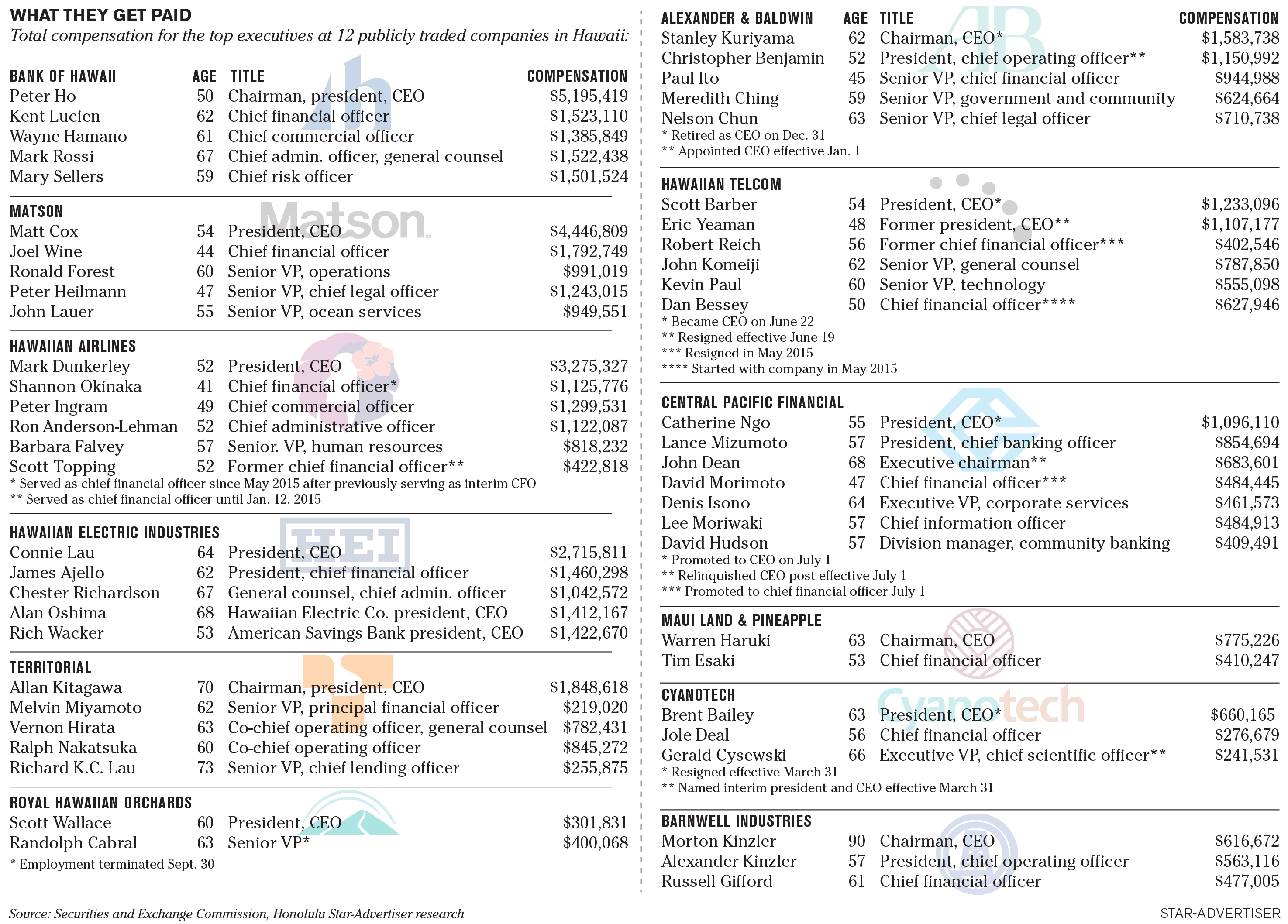

Chief executive officers at Hawaii’s 12 largest publicly traded companies took an 18.3 percent hit in their total compensation last year.

But don’t feel too sorry for them. Their pay package still averaged $2 million.

That’s 47 times more than the $42,200 that an average worker in the state earned in 2015.

For the second year in a row, Bank of Hawaii’s Peter Ho, 50, topped the state’s CEO rankings with total compensation of $5.2 million. That’s 34 percent less than the $7.9 million he received in 2014, due to a drop in stock awards. Still, Ho collected nearly three-quarters of a million more in total compensation than the runner-up CEO, Matson’s Matt Cox, who took in $4.4 million after getting a 9.3 percent raise from $4.1 million.

Altogether, six of the 12 CEOs received higher compensation than the previous year, according to a Honolulu Star-Advertiser analysis of Securities and Exchange Commission filings. Two of the increases came from CEOs who were promoted about midyear from lower positions with their respective companies.

Scott Barber became president and CEO of Hawaiian Telcom on June 22 after Eric Yeaman resigned to accept a position as president and chief operating officer at First Hawaiian Bank. Barber, who was promoted from chief operating officer, finished the year with total compensation of $1.2 million, up 29 percent from $955,806 in 2014. Yeaman exited with $1.1 million.

Central Pacific Bank also saw a changing of the guard as John Dean relinquished his CEO title July 1 to Catherine Ngo, who became only the second active female CEO at a publicly traded Hawaii company alongside Connie Lau of Hawaiian Electric Industries. Ngo, who was promoted from co-president and chief operating officer, finished the year with total compensation of $1.1 million, up 71.9 percent from $637,776 in 2014. Dean, who remained as chairman, ended 2015 with a total pay package of $683,601.

BESIDES HO and Cox, Hawaiian Airlines President and CEO Mark Dunkerley was the only other top executive to crack the $3 million club in 2015 as his total compensation came in at $3.3 million, up 5.5 percent from $3.1 million in 2014.

Lau, president and CEO of HEI, dropped two spots to fourth place and received $2.7 million, her lowest total since 2007 and a 51.7 percent drop from her $5.6 million pay package in 2014. The main reason for the decline was $2 million less in her pension value and nonqualified deferred compensation earnings. Until 2014 Lau had been the highest-earning CEO for three straight years. If Florida-based NextEra Energy Inc. succeeds in getting its proposed $4.3 billion takeover of HEI approved by the state Public Utilities Commission, Lau likely would become the highest-paid CEO for 2016 because of a change-in-control agreement in her contract. Lau could get about $10 million if the sale goes through, plus $2.2 million in retirement pay.

Morton Kinzler, chairman and CEO of Barnwell Industries, remained the oldest top executive at age 90. He has been a director since he founded the company in 1956, and has been CEO since 1971 and chairman since 1980. His total compensation, though, dropped 30.8 percent to $616,672, from $890,546, after the company cut executives’ pay twice last year due to low oil and gas prices that have hurt the company’s finances. Barnwell derives about half of its revenue from oil and natural gas production in Canada and the remainder from real estate development on Hawaii island and water drilling in the state. Two months ago Barnwell cut its top executives’ pay again. Their pay is down more than 60 percent since the beginning of 2015.

While Kinzler is by far the longest-serving CEO, he’s not the oldest member of Barnwell’s board. That honor goes to 92-year-old Martin Anderson, senior partner of Honolulu law firm Goodsill Anderson Quinn & Stifel. Anderson has been a director since 1985.

ANOTHER notable director is Honolulu Mayor Kirk Caldwell, 63, who is up for renomination of his three-year term on the board of Territorial Savings Bank at its May 26 shareholders meeting. Caldwell, who has a mortgage loan at the bank, has been a director since 2007. He received total director compensation last year of $47,890.

The SEC requires companies to list the compensation of their CEO, chief financial officer and the other three most highly compensated employees serving as executive officers at year-end. All ages are as of the time that the reports were filed with the SEC. The SEC also requires the companies to list compensation for their directors.

Just as there were two new CEOs in 2015 in Barber and Ngo, there will be at least two new CEOs in 2016.

Stanley Kuriyama, who retired as CEO of Alexander & Baldwin on Dec. 31, received a pay package worth $1.6 million, down 28.5 percent from $2.2 million in 2014. He is retaining his role as chairman of the company. His replacement as CEO is President and Chief Operating Officer Chris Benjamin, who received $1.2 million in his former positions last year.

Cyanotech President and CEO Brent Bailey, whose compensation increased 3 percent to $660,165 from $640,795 in 2014, resigned March 31 and was replaced on an interim basis by founder and Chief Scientific Officer Gerald Cysewski, who is not receiving any additional compensation while fulfilling his new roles. Cysewski earned $241,531 in 2015.

Among the perks some of the 12 CEOs received last year were club membership dues, car and parking allowances, in-office meals, more vacation than employees with similar length of service, reimbursement for out-of-pocket medical expenses and reimbursement of taxes related to flight benefits.

More than half of the Hawaii CEOs had stock awards and stock options with values that exceeded their salaries. Cox, Ho and Dunkerley all had stock awards in excess of $1.5 million.

Stock awards, which are tied to performance benchmarks such as a company’s return on equity and are paid over a multiyear period, were the single largest category of compensation in 2015. Stock awards averaged $782,632 for the CEOs, with Cox’s $2.4 million leading the way and Ho close behind at $2.3 million.

The second-largest component of executive pay last year was “nonequity incentives,” an annual cash payment tied to meeting certain corporate goals. The average nonequity payment was $562,210, topped by the $1.95 million received by Ho. Lau was second at $1.25 million.

Salaries were the third-highest source of compensation, averaging $549,602 in 2015. Allan Kitagawa, chairman, president and CEO of Territorial Savings Bank, led the field with a salary of $851,124, which is the same amount it has been since 2013. Kitagawa’s total compensation was $1.8 million, down 5.8 percent from $2 million in 2014. Lau had the second-highest base salary at $839,450.

Among other top executives, Maui Land & Pineapple Chairman and CEO Warren Haruki saw his pay package dip 1.2 percent to $775,226 from $784,576, while Royal Hawaiian Orchards President and CEO Scott Wallace received a 0.4 percent increase in compensation to $301,831 from $300,709.

Ho, who is the youngest CEO among the 12 publicly traded companies and heads the state’s second-largest bank, also had the distinction of being the highest-paid bank executive. Bob Harrison, chairman and CEO of First Hawaiian Bank, the largest bank in the state, is not required to disclose his compensation because the company is owned by French banking giant BNP Paribas. However, Harrison’s compensation eventually will be disclosed if BNP follows through with an initial public offering of First Hawaiian that reportedly could occur as early as June.

American Savings Bank, the third-largest bank in the state, also might go public this year as part of the deal involving NextEra’s proposed purchase of Hawaiian Electric Industries, the holding company for American Savings and Hawaiian Electric Co., the state’s largest utility.

American Savings President and CEO Rich Wacker, one of the highest-paid executives for HEI in 2015, received total compensation of $1.4 million, down 22.3 percent from $1.8 million in 2014. Wacker would receive a change-in-control payment of $3.8 million this year only if the bank were sold and his job is eliminated. But neither of those dual triggers are being contemplated as part of NextEra’s purchase of HEI and planned spinoff of the bank.

Hawaiian Electric President and CEO Alan Oshima, who was appointed to the position Oct. 1, 2014, received $1.4 million in 2015, up 27.7 percent from $1.1 million in 2014 when he spent part of that year as executive vice president for corporate and community advancement for HEI and part of the time as a senior HECO officer on loan from HEI.

Correction: An earlier version of this story said American Savings President and CEO Rich Wacker would receive a change-in-control payment of $3.8 million but didn’t list the dual triggers required for that payment to occur.